Furniture Stores Near Me Things To Know Before You Buy

Wiki Article

All about Furniture Stores

Table of ContentsAll about HeadboardSectional Sofas - QuestionsHeadboard for DummiesThe 7-Minute Rule for CouchesThe 8-Minute Rule for Furniture StoresFascination About Chair

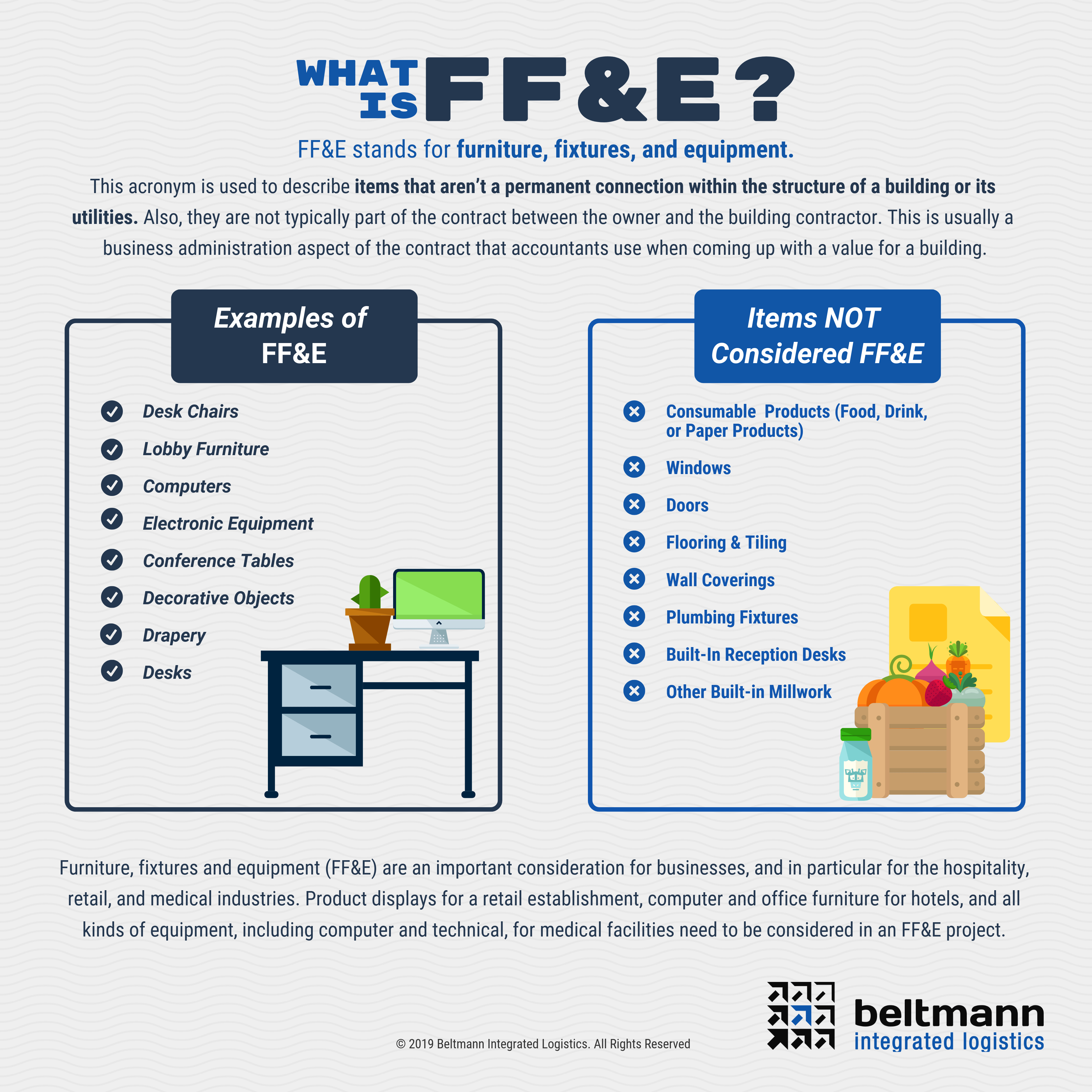

The same audit policies that apply to improvements to structures likewise apply to enhancements to facilities. Infrastructure items are generally decreased over an useful life of twenty years. As assets near the end of their approximated lives, the price quotes ought to be evaluated for precision of the initial estimate and adapted to show the awaited variety of years of proceeded usage. Nonexpendable Personal Effects Examples of nonexpendable individual residential property consist of machinery, executes, devices, furnishings, automobiles and other device with a device price of$5,000 or more and a minimal life span over of one year. The adhering to listing includes several of the expenses that need to be capitalized in the ideal property account: The original negotiated purchase cost. Cost of setup, including site preparation, setting up, and installing.Price of test runs as well as various other examinations required before the possession can be put right into full operation. Price of replacing tools gotten in a previously owned state. Nonexpendable personal residential or commercial property gotten by contribution, or the intent of contribution, e. g. purchase for one dollar, ought to be tape-recorded on the basis of an appraisal of the marketplace worth at the date of purchase. Note: The exact same accounting policies that relate to building enhancements put on improvements to nonexpendable individual property. As assets near the end of their approximated lives, the quotes need to be assessed for accuracy of the initial quote and adapted to reflect the expected variety of years of continued usage. Any modification of approximated lives is a change in accounting quote and also should be applied to current and future devaluation calculations. If the furniture was sold independently from the rental, and also that furnishings is noted as an asset for the rental property in the SCH E area of the program, then on the SCH E you would certainly suggest the furniture was removed for personal use. The sale of the furniture would be reported individually in the" Sale of Organization Building "section. This will lead to the sale exact outcome, as if you place in the cost you paid for that furniture, the amount of depreciation will be precisely the like that cost you.

The Ultimate Guide To Sofa

spent for the furniture. They primarily cancel each other out giving you an expense basis of absolutely no anyhow. On the"Sale of Company or Rental Residential property"Screen click YES Then on the next screen additionally entitled "Sales of Business or Rental Residential or commercial property "get in a description for the furniture, adhered to by the date you obtained the furniture.( Doesn't need to be specific)next off, the day you sold it, followed by the sales cost.As local living room furniture business owner, one of your major problems would certainly drop in the location of comprehending the various kinds and also categories of possessions in addition to exactly how to take advantage of them to the utmost. If as an example you possess and run a coffee shop, restaurant, hotel, hotel, holiday park, club, a function centre, an indoor style business or any type of various other organization looking for a large range of top quality fixtures and furnishings items; then a sound furniture financial investment plan remains in order.

The Ultimate Guide To Sofa

And because you are asking this question, the anticipation is that you are not really sure what is suggested by the term "present properties." Keep reading and also I'll walk you via learning what current possessions as well as dealt with assets are, as well as how you can maximise your spending plan and extend the life and use of your furniture as well as components.These are substantial or lengthy term properties that include structures, land, components, equipment, automobiles, machinery and also furniture. As opposed to current assets, furnishings and other type of set properties are not made use of for furniture liquidation functions to please a financial debt, to pay earnings or to assist daily company procedures economically.

The Main Principles Of Dresser

These are physical, concrete properties that are most likely or anticipated to stay throughout the life-span of the company. So since you recognize furnishings and fixtures are not present yet set assets, right here's something crucial to consider. If you remain in the market for friendliness furniture and fixtures, there are a variety of choices you can consider the best feasible return on your financial investment despite the smallest budget plan.The Furniture and also Furnishings (Fire Safety) Laws specify demands for the fire resistance for residential upholstered furniture, furnishings and various other products consisting of furniture. These Laws are implemented by Trading Criteria. As local business owner, among your major problems would drop in the area of recognizing the various kinds and categories of assets as well as just how to utilize them to miraculous - furniture. If as an example you have and also run a cafe, dining establishment, hotel, resort, holiday park, club, a feature centre, an interior decoration business or any type of other business seeking a vast array of quality fixtures and also furniture products; then an audio furniture financial investment plan is in order.

Coffee Table for Dummies

These are tangible or long-term properties that consist of buildings, land, fixtures, devices, automobiles, equipment as well as furnishings. As opposed to existing assets, furnishings and also various other type of fixed properties are not utilized for liquidation purposes to satisfy a debt, to pay earnings or to assist daily company procedures monetarily.

The Main Principles Of Headboard

Report this wiki page